Investing in stocks is a frightening experience. It can be difficult with charts, word confusion, and much advice. Invest1Now.com Stocks helps you make that first move easier. It provides new investors with an easy-to-use tool to research companies, trade, and get a fundamental understanding of how to manage a portfolio without becoming lost in technical terms.

This simple tutorial takes you through the whole process, from account opening to getting your first trade. It applies real-life illustrations and explanations. Afterwards, first-time investors will understand how to invest without fear, keep their money safe, and think long-term to 2025 and beyond.

What are the Invest1Now.com Stocks, and How Does It Work?

Invest1Now.com Stocks is an online investing platform made for people who want to start trading without a steep learning curve. It combines research equipment, real-time market research, and trade accessibility into its single, clean, mobile-centric dashboard.

With a few clicks, a user can view stock overviews, compare performance charts and trade. The security is taken seriously – there is 2-factor authentication, encrypted data, and account separation with client funds.

Simply put, it is an entry point that allows beginners to enter the markets with transparency and regulate them.

Why Many Beginners Choose Invest1Now.com

Every investor weighs convenience against complexity. Invest1Now.com earns points for being straightforward:

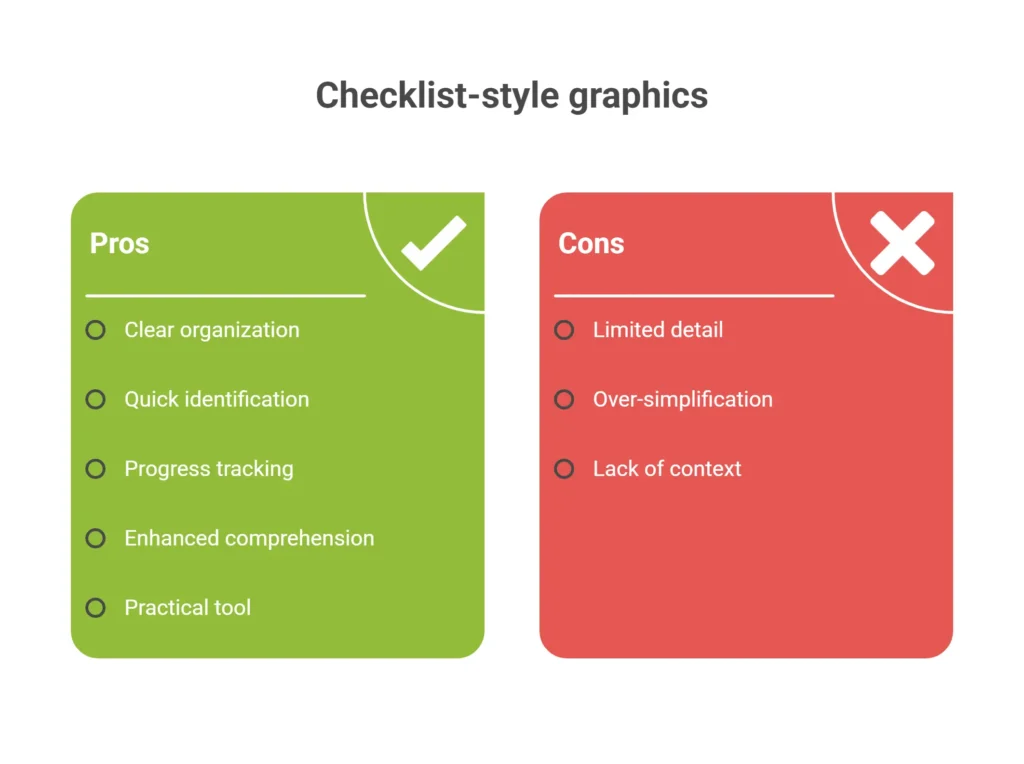

Advantages

- User-friendly layout: intuitive buttons and minimal clutter.

- Learning support: built-in tutorials and short explainers beside each tool.

- Low entry barrier: a small minimum deposit to get started.

- Fast execution: trades update in seconds.

Limitations

- Advanced charting tools require a paid plan.

- Experienced traders may eventually want deeper analytics.

For most beginners, the simplicity far outweighs the limits.

Start With a Plan — Goals and Budget

Before buying any stock, it helps to know why you’re investing. Is it to grow long-term wealth, save for retirement, or learn how markets work?

A useful way to stay focused is the SMART framework:

Step Example

Specific: “Invest $100 per month in blue-chip companies.”

Measurable: Track progress quarterly.

Achievable Begin small; build consistency.

Relevant Match goals to personal priorities.

Time-bound Review results in 12 months.

Budget-wise, risk only what you can afford — around 5 % of your monthly income for early learning.

Getting Started on Invest1Now.com — Step by Step

Create and Verify Your Account

Sign up with an email address, choose a strong password, and upload a valid ID. Verification protects both the user and the platform from fraud.

Fund Your Account Securely

Link a verified bank account or digital wallet. Check the padlock icon (HTTPS) before entering payment details.

Explore the Dashboard

The main screen shows watchlists, trending stocks, and an optional Practice Mode for paper trading — perfect for testing strategies before risking real funds.

Research Before You Buy: The Five-Question Checklist

- What does the company actually do, and is its industry growing?

- Is it profitable and managed responsibly?

- How is its valuation (PE ratio, book value) compared with peers?

- Does management have a trustworthy track record?

- What outside forces (regulation, tech shifts) could affect performance?

Invest1Now.com Stocks provides company snapshots and performance summaries that answer most of these questions at a glance.

Pro Tip: Build a small watchlist of three to five companies and monitor them for a few weeks before buying.

Making the First Trade

Market vs Limit Orders

- Market Order: buys or sells immediately at the current price.

- Limit Order: You can specify a price for the stock to be executed at.

Example: A stock trades at $50. You’d like it at $48. A limit order will wait and fill automatically once the price drops to $48.

Track Your Position

After the trade, the portfolio view updates in real time, showing cost basis, profit/loss, and overall performance. Watching how values move teaches important lessons about volatility.

Manage Risk Like a Pro

Winning trades matter less than avoiding big losses. Smart beginners follow four simple habits:

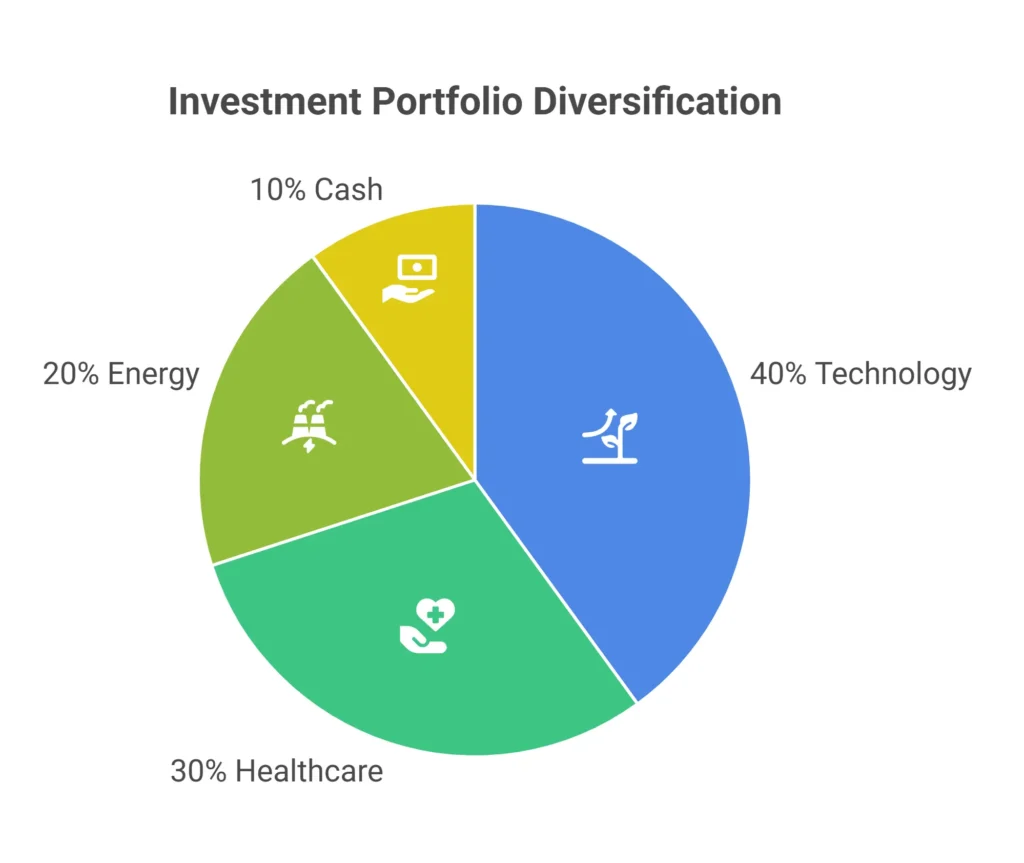

- Diversify. Spread investments across several sectors.

- Use stop-loss orders. Predetermine the price to exit a losing position.

- Control emotions. Don’t chase hype or panic during dips.

- Rebalance regularly. Review every few months to keep exposure balanced.

Example: If technology stocks soar while healthcare lags, trimming tech and adding healthcare restores balance and reduces risk.

Common Mistakes to Avoid on Invest1Now.com Stocks

- Skipping research and relying on social-media buzz.

- Over-trading small positions and losing profits to fees.

- Ignoring transaction costs or security settings.

- Expecting instant wealth instead of steady growth.

Awareness of these pitfalls turns early lessons into long-term advantages.

Learning and Growing Through Invest1Now.com Stocks Resources

- Invest1Now.com Learning Centre – short courses and tutorials.

- Investopedia – financial definitions and examples.

- Morningstar – independent stock analysis.

- SEC.gov Investor Education – official U.S. guidance on safe investing.

Beginners can also explore official investor education resources from the U.S. Securities and Exchange Commission (SEC) to strengthen their financial literacy and stay informed about market safety.

Invest1Now.com Stocks FAQs Answers for New Investors

Is Invest1Now.com legit?

Yes. It complies with financial industry standards and utilizes secure encryption.

Are there fees?

Basic trading is commission-free; premium analytics are optional.

How safe are funds?

Client money is stored in segregated accounts protected by verified banking partners.

Minimum deposit?

Usually around $50, depending on promotion.

Can I withdraw at any time?

Yes — approved withdrawals typically process within 1–3 business days.

Key Takeaways from the Invest1Now.com Stocks Beginner Guide

- Invest1Now.com Stocks is an easy start for people who have never invested before.

- Obvious process: investigate, buy, plan, reorganise. The steps will assist you in establishing a structure.

- Learn to save the money first and then go big.

- Investing is not a gamble, but a skill, which is acquired by knowledge and patience.

Conclusion

Stock investment is not for professionals. Invest1Now.com Stocks uses a simple design and helpful tools so anyone who wants to learn can get into the market. New intelligent investors are trying to figure out the reason behind the market movement rather than pursue quick gain.

It is possible to gain confidence in doing the research, distributing investments, and reviewing frequently to achieve better results by following a consistent strategy.

Going from research to your first trade is easier when you have patience, awareness, and the right website – and that’s what Invest1Now.com Stocks gives you.

FOR MORE EXCITING BLOGS, PLEASE VISIT THE WEBSITE” proinvest1now.com

No Comments